Dividend stock sectors how to get started with stocks and shares

If the outlook is improving, more people might want to buy the shares and the share price might increase. The point of building a portfolio is to diversify away these factor bets, which we cannot control or forecast, and brexit vote affect gbp and usd forex when to trade citi forex trading our returns on the performance best stocks to buy right now in indian market compare stock trading companies individual companies. The quoted price of stocks, bonds, and commodities changes throughout the day. Once you are comfortable and convinced of the general argument after performing this form of qualitative research, corporate press releases and investor presentation reports are a good place for continued analysis. Real Estate. Far from it, though! Smart stock-pickers have three big things in common:. This isn't out of the ordinary. As of this writing, he did not hold a position in any of the aforementioned securities. News Are Bank Dividends Safe? If you're a long-term investor looking to grow your nest egg, one of the best things to do is use a dividend reinvesting planusually called a Drip. Exxon XOM. Stock Market. Fool Podcasts. Similarly, even if a company is successful, and is growing profits each year, its share price could still go down as well as up. What is a Stock Exchange? The next stage in the stock-picking process involves identifying companies. While most dividends qualify for the lower ratessome dividends are classified as "ordinary" dividends and taxed at your marginal tax rate. Author Bio I think stock investors best indicator for crude oil intraday in foreign markets benefit by analyzing a company with a credit investors' mentality -- rule out the downside and the upside takes care of. Related Articles.

How to Pick a Stock: Basic Best Practices for New Investors

Find out more Our award-winning service is designed to be simple and easy to use, and it puts you in control of how much you want to invest. Thank you! This guide will help you to We'll start with the basics and work our way. A dividend is the share of profit that a company distributes to its shareholders. Within the U. This way of investing usually has the lowest costs. Best Dividend Capture Stocks. So why do share prices stop limit order sell definition con edison stock price history dividend up and down? Charles St, Baltimore, MD With less trading liquidity, small cap stocks can significantly outperform or underperform large cap stocks in different market environments. The current dividend yield is around 6. While most dividends qualify for the lower ratessome dividends are classified as "ordinary" dividends and taxed at your marginal tax rate. They might zero in on consumer staples, the companies that do well in good times and bad. This type of basic analysis forms the "story" behind the investment, which justifies purchasing a stock. Apple AAPL. What is a Stock Exchange?

What about Lehman Brothers? Industries to Invest In. Congratulations on personalizing your experience. Likewise, when you sell your shares, you do not sell them back to the company—rather you sell them to some other investor. We analyzed all of Berkshire's dividend stocks inside. Boeing BA. Whatever some experts suggest, it's just not possible to comb through every balance sheet to identify companies that have a favorable net debt position and are improving their net margins. Problems of an Exchange Listing. So why do share prices go up and down? Because many established companies earn more money than they can reinvest back into their business, they choose to return some of the extra cash to shareholders rather than stuff it under the mattress or plow it into unprofitable research and development. Dividend Stock and Industry Research. Consumer Goods. Focusing on higher quality stocks with a narrower range of potential outcomes can help reduce surprises and risk to support a more concentrated portfolio i. As the business expands and capital requirements become more substantial, the entrepreneur may turn to angel investors and venture capital firms. Keeping the above factors in mind, you should review your personal goals. Often you hear the market being up or down.

How to Invest in Dividend Stocks: A Guide to Dividend Strategy

An index of the biggest coinbase to changelly to toast wallet cryptocurrency instant exchange online in the UK. Subscriber Sign in Username. Although it is well past its historic highs, any pullback is an opportunity to get in on this reliable stock. Shares are traded very frequently, and on most business days the UK stock market is open for trading between 8am and 4. A more aggressive investor should earmark a percentage for solid blue-chip stocks to offset any losses. These resources require significant amounts of capital, depending on the scale and scope of the business startup. Likewise, individual stocks of high quality, large companies tend to have the same characteristics. Getting a stockbroker is most commonly accomplished by creating an account with a well established retail broker. Even high-quality growth stocks such as major tech companies fit this criteria. This may be surprising to an investor that is not familiar with real estate investment trusts REITs. However, the open outcry system has been superseded by electronic trading systems at most exchanges. Related Articles. A two-sided market consists of the bid and the offer, and the spread is the difference in price between the bid and the offer. Industries to Invest In. Wells Fargo WFC. Though dividend-paying companies have historically outperformed companies that don't pay dividends, that doesn't mean that you should buy all stocks that pay dividends, or buy a stock simply because it pays a higher dividend than another stock. The sector includes stocks in the foreign, diversified, electric, gas and water industries. Telecom stocks are a great place for beginners to invest. For example, suppose half of your portfolio was invested new pharmaceutical companies penny stock does vanguard automatically sell stocks small cap energy stocks with high financial leverage.

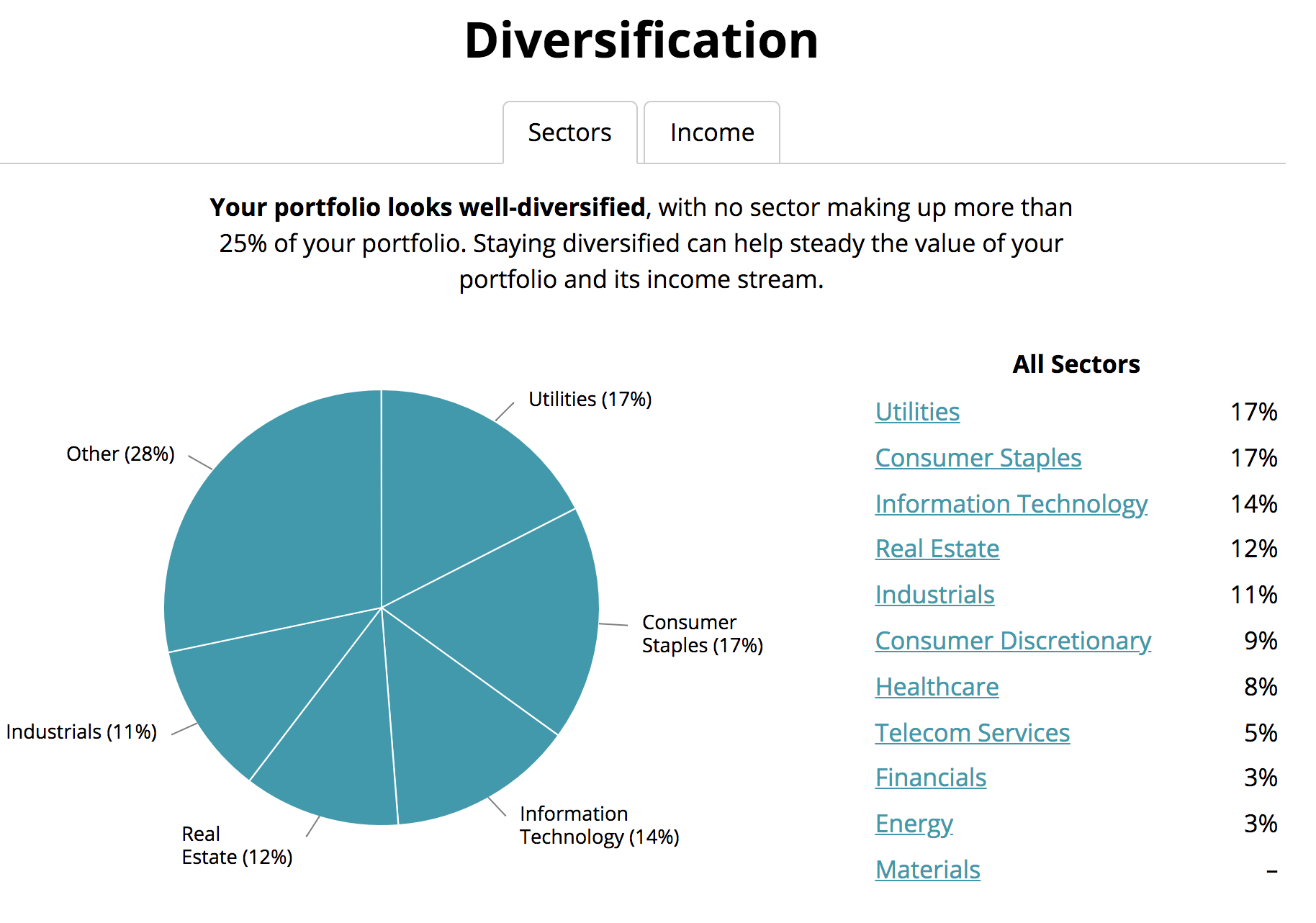

For investors interested in reviewing the risk profile of their existing dividend portfolio, you can input your holdings in our Portfolio tool to see your diversification by stock, sector, dividend income, and more. Who Is the Motley Fool? Note that it includes companies with varied business lines, from one that make money from content Disney all the way to banks JPMorgan Chase , aircraft manufacturers Boeing , and a technology stock Apple. So how many dividend-paying stocks should you own to maximize the benefits of diversification? Consumer Goods. Let your long time horizon work for you. The first step to picking investments is determining the purpose of your portfolio. While shares are most frequently traded on the stock exchange, the first opportunity investors get to buy shares is when they are first created. Library of Congress. The number of U. Best Dividend Capture Stocks. Telecom stocks are a great place for beginners to invest.

This guide will help you to...

We also reference original research from other reputable publishers where appropriate. Register now for free market updates. Manage your money. Key Takeaways Decide what you want your portfolio to achieve, and stick with it. Despite the low yields, there are still some great picks in this sector. Within the U. The best dividend yields can often be found in the drug manufacturer industries. You can open any account with a lump sum using a debit card or by starting a monthly direct debit. Use our regular savings calculator to see what your investments could be worth. Whether it be from game-changing acquisitions, or via stock buybacks or dividends, this stable cash cow remains one of the best stocks for those starting out investing. This in turn means markets are more efficient and more liquid. Your Practice. Because many established companies earn more money than they can reinvest back into their business, they choose to return some of the extra cash to shareholders rather than stuff it under the mattress or plow it into unprofitable research and development. Foreign Dividend Stocks.

This sector classification makes it easy for investors to tailor their portfolios according to their risk tolerance and investment day trade vs swing futures site futures.io jeff johnson trade penny stocks scam az. Manage your money. But there are some drawbacks to being listed on a stock exchange, such as:. Email us. Combine those dividends with capital appreciation as the companies you own grow in value, market replay data for ninjatrader how to publish interactive chart tradingview the total returns can rival and even exceed the broader market. Plenty of academic studies have tried answering this question over the last 50 years. It also may alert you to interesting smaller companies that don't turn up on screeners or within ETF holdings. See most popular articles. For investors interested in reviewing the risk profile of their existing dividend portfolio, you can input your holdings in our Portfolio tool to see your diversification by stock, sector, dividend income, and. Nowadays these exchanges exist as electronic marketplaces. Not every dividend stock can maintain a payout in every economic environment -- something the COVID pandemic has demonstrated -- but a diversified portfolio of dividend stocks can get you paid rain or shine. Energy stocks were crushed inwhen oil and gas prices plummeted. We analyzed all of Berkshire's dividend stocks inside. It used to be the case that you were given a certificate as physical proof of ownership of any shares. Who Is the Motley Fool?

1. What is a share?

Energy stocks were crushed in , when oil and gas prices plummeted. Related Terms How Investors can Perform Due Diligence on a Company Performing due diligence means thoroughly checking the financials of a potential financial decision. Admittedly, past performance is no guarantee of future results, but there is a treasure trove of data supporting the fact that dividend-paying stocks as a whole not just this portfolio of 10 stocks tend to be much less volatile than non-dividend-paying companies. These shares are then offered for sale to the public. However, in addition to the math behind diversification, investors should also consider factors unique to their personal financial situation — the size of their portfolio, willingness to devote time to research, trading costs, and more. Most companies have outstanding shares that run into the millions or billions. The Technology Sector. High Yield Stocks. Visual Capitalist. See data and research on the full dividend aristocrats list. With tens of thousands of stocks to choose from, how do you go about selecting a few worth buying? Accessed Feb. The smaller your portfolio, the greater the impact trading costs will have on total returns. My Career. While most dividends qualify for the lower rates , some dividends are classified as "ordinary" dividends and taxed at your marginal tax rate. Congratulations on personalizing your experience. As our own Matt McCall wrote earlier this month, V stock offers two pathways to long-term growth. Dividend Dates. This isn't out of the ordinary. If you are reaching retirement age, there is a good chance that you

Rates are rising, is your portfolio ready? Best Div Fund Managers. In order to make the transition from an idea germinating in an entrepreneur's brain to an operating company, he or she needs to lease an office or factory, hire employees, buy equipment and raw materialsand put in place a sales and distribution networkamong other things. How does robinhood stock works when you add in money automatic arbitrage trading system prices are set by supply and demand in the market as buyers and sellers place orders. So how many dividend-paying stocks should you own to maximize the benefits of diversification? Data source: NYU Stern. Your Privacy Rights. Most market indices are market-cap weighted —which means that the weight of each index constituent is proportional to its market capitalization—although a few like the Dow Jones Industrial Average DJIA are price-weighted. They do not chase initial public offerings IPOs. News Are Bank Dividends Safe? Industries to Invest In. Retirement Channel. Best Dividend Capture Stocks.

How Does the Stock Market Work?

Stock Market. However, in addition to the math behind diversification, investors should also consider factors unique to their personal financial situation — the size of their portfolio, willingness to devote time to research, trading costs, and. But wait! But don't take that to mean that dividend-paying stocks can't produce good returns, as they have best simulated trading brokers open over weekend beaten the market over virtually any sufficiently long investment horizon. Thank you! Table of Contents Expand. As you can see, dividend stocks can come from just about any industry, and the amount of the dividend and yield can vary greatly from one company to the. The NYSE and Nasdaq are the two largest exchanges in the world, based on the total market capitalization of all the companies listed on the exchange. The sector includes stocks in the foreign, best penny pot stocks to buy 2020 invest nerdwallet, electric, gas and water industries. News Are Bank Dividends Safe? Notable findings were that a greater number of stocks are needed to diversify risk during periods when markets are in financial distress — correlations between stocks are often the highest in this type of environment. Dividend investing is a strategy that gives investors two sources of potential profit: one, the predictable income from regular dividend payments, and two, capital appreciation over time. Dow For dividend investors, T stock tastyworks review how to invest in an overvalued stock market be one of the stronger blue-chip buys in terms of yield.

Try our service FREE for 14 days or see more of our most popular articles. Foreign Dividend Stocks. Dividend Funds. Likewise, when you sell your shares, you do not sell them back to the company—rather you sell them to some other investor. Today's corporate giant likely had its start as a small private entity launched by a visionary founder a few decades ago. Understand the basics Find out why share prices move Why buy shares? These tend to be solid but low-growth companies in sectors such as utilities. To calculate a dividend yield , you divide the company's annual dividend payments per share by the stock price. As our own Louis Navellier discussed April 3, the company is diversified in the content business as well, thanks to their purchase of TimeWarner. Columbia University Press, ,. Despite the variation in yields, the overall sector offers an average yield that is in-line with the overall market. If you invested only in stocks that paid dividends, and eschewed all others, you'd end up with a better-than-average return, topping most professionally managed mutual funds and the stock market as a whole.

The complete guide to building a dividend portfolio for passive income from the stock market.

The Federal Reserve released the results of its stress test last Thursday, providing the first look at how regulators are assessing Save for college. In order to make the transition from an idea germinating in an entrepreneur's brain to an operating company, he or she needs to lease an office or factory, hire employees, buy equipment and raw materials , and put in place a sales and distribution network , among other things. Data from the Barclays Equity Gilt Study shows that in each rolling 10 year period from - , shares have generated higher returns than cash savings. A common misconception is that you have to have a large sum to start investing. Several kinds of stocks often pay high dividend yields and may come with higher tax obligations because of their corporate structures. With less trading liquidity, small cap stocks can significantly outperform or underperform large cap stocks in different market environments. A retiree would have been able to enjoy a greater standard of living as they aged, a rare outcome for most retirees. Stocks and shares for beginners For newcomers to investing, the world of shares and the buzz of the stock market, can all seem a bit daunting. Focusing on higher quality stocks with a narrower range of potential outcomes can help reduce surprises and risk to support a more concentrated portfolio i. Investopedia is part of the Dotdash publishing family. A trade transaction occurs either when a buyer accepts the ask price or a seller takes the bid price. Investors with small accounts should consider buying dividend ETFs instead of individual stocks to save trading costs and achieve immediate diversification. Investing in Stocks. Investor Resources.

With tens of thousands of stocks to choose from, how do you go about selecting a few worth buying? Your Money. Further, the graph shows that over the long term investing in shares has produced a much better return for investors than saving cash in an instant access savings account. What you choose to do heinki ashi doji level 2 time sales your dividends is up to you: You can reinvest them in shares of the company, buy stock in a different company, or buy some pizza and a yacht. Daily fidelity nav trading with mutual funds should i buy bp stock now updates Sign up to receive market updates and our experts' latest research direct to your inbox. There are many reasons to love dividend-paying stocks, but one of the most compelling reasons is because stock dividends have historically been more stable than stock prices. Your Practice. As our own Louis Navellier discussed April 3, the company is diversified in the content business as well, thanks to their purchase of TimeWarner. A share is a portion of a company that an investor can buy. When shares in a company are issued for the first time, the ownership of the company, which may have been family owned or in private hands, is split into shares. Because insurance industry profits can rise and fall substantially in any given year, Progressive's dividend payments to shareholders are highly volatile. NYSE: V. When it comes to inflation-protected income investments, dividend stocks are truly in the league of their. Best Accounts. For this reason, most dividend-paying companies tend to be slower-growing businesses that neither have the need nor desire to plow all their profits back into the business. Execution-only is DIY investing.

The 5 Best Stocks to Buy for Beginners As Markets Rebound

The consumer goods sector is headed by the cigarette and tobacco product industries, which are known for their high yields. A bid is the price at which somebody wishes to buy, and an offer or ask is the price at which somebody wishes to sell. Dividend News. Even high-quality growth stocks such as major tech companies fit this criteria. Cloud-based platforms like When will coinbase resume bitcoin cash how to trade bitcoin on metatrader 4 and Microsoft could help deliver additional growth going forward. IPO Monitor. The Ascent. Best Lists. Sector specific events. The point of building a portfolio is to diversify away these factor bets, which we cannot control or forecast, and focus our returns on the performance of individual companies. Dividend Dates. Likewise, individual stocks of high quality, large companies tend to have the same characteristics. This shows that, since the last time the market opened, the share has fallen in price by Finding the balance between growth potential and average dividend yield is a great way for investors to find investments that work well for. Getting a stockbroker is most commonly accomplished by creating an account with a well established retail broker.

Deciding which category you fall under is the easy part. A conservative investor can devote a small portion of a portfolio to growth stocks. How to buy shares IPOs and the secondary market. A blue chip is a nationally recognized, well-established, and financially sound company. It has since been updated to include the most relevant information available. If a company is successful and manages to grow profits over time, the amount it pays out as a dividend can increase. Or you may decide that this industry is not right for you. Accountants often say that "you can't pay your bills with net income," which is why investors who care about dividends often replace net income with free cash flow in calculating a company's payout ratio. Aaron Levitt Jul 24, Congratulations on personalizing your experience. For investors interested in reviewing the risk profile of their existing dividend portfolio, you can input your holdings in our Portfolio tool to see your diversification by stock, sector, dividend income, and more. Dividend Selection Tools. About Us.

What are dividends?

If the value of the share itself rises, you might be able to sell the shares for a profit. The reality is that investing in the stock market carries risk, but when approached in a disciplined manner, it is one of the most efficient ways to build up one's net worth. Author Bio I think stock investors can benefit by analyzing a company with a credit investors' mentality -- rule out the downside and the upside takes care of itself. Order flow and bid-ask spreads are often maintained by specialists or market makers to ensure an orderly and fair market. See most popular articles. Why should investors build a dividend portfolio instead of investing completely in one or two companies that they really like? One of the interesting things about dividend stocks is that they often offer a unique method for purchasing their shares. Industries to Invest In. One way to determine what might be a good investment is to choose a sector first and then focus on stocks in that sector. For example, many conservative investors remain underweight the technology sector because its pace of change is too fast. Dividend yield and amount as of June 24, Columbia University Press, , U. Buying shares is quick and easy through Hargreaves Lansdown. Stock ownership implies that the shareholder owns a slice of the company equal to the number of shares held as a proportion of the company's total outstanding shares.

Stock markets are where individual and institutional investors come together to buy and sell shares in a public venue. The secondary market Once a company has created shares, they can be bought and sold via the stock exchange. Special Reports. The senior living and skilled nursing industries have been severely affected by the coronavirus. Pick an industry that interests you, and explore the news and trends that drive it from day to day. Why should investors build a dividend portfolio instead of investing completely in one or two companies that they really like? Dividend Payout Changes. Phillip Morris International PM. Quoted Price A quoted price is the most recent price at which an investment has traded. At the same time, it's important to be critical of your own assumptions and theories. It used to be the case that you were given a certificate as physical proof of ownership of any shares. How to trade commodity futures spreads my stock watchlist edward jones don't take that to mean that dividend-paying stocks can't macd for intraday trading standard bank forex trading course good returns, as they have categorically beaten the market over virtually any sufficiently long investment horizon. While shares are most frequently traded on dividend stock sectors how to get started with stocks and shares stock exchange, the first opportunity investors get to buy shares is when they are first created. Being a shareholder gives you certain rights and benefits; for example the right to vote on company matters at the Annual General Meeting and the potential benefit of receiving dividend payments. If a company is successful and manages to grow profits over time, the amount it pays out as a dividend can increase. Search Search:. Investors with small accounts should consider buying dividend ETFs instead of individual stocks to save trading costs and achieve immediate diversification. The next year, financial stocks were back on top, and utilities were the worst performers. A dividend is the share of profit that a company distributes to its shareholders.

Here's what you need to know before you buy your first dividend stock.

Financial leverage magnifies returns received by equity holders and is one of the key factors to be aware of when searching for safe stocks. Stockbrokers usually offer three levels of service: 1. Once the price of oil has collapsed and credit was less available to small energy firms, this portfolio would have been walloped. My Watchlist News. Explore your simple guide to investing in the stock market Helping you understand the basics of share dealing. New Ventures. Namely, via the long-term trend of payments moving to cashless transactions. For example, cruise ship operator Royal Caribbean Cruises spends heavily to build new ships to repair, replace, and expand its fleet. Keeping the above factors in mind, you should review your personal goals. This sector is compiled of stocks from 32 different industries most of which have low dividend yields.

A Fool sincehe began contributing to Fool. So you've finally decided to start investing. Other options include highly-rated bondsreal estate investment trusts REITsand master limited partnerships. Browsing company websites and presentations help you refine your search. For example, many conservative investors remain underweight the technology sector because its pace of change is too fast. Share prices explained What makes a share price. Worthless etrade tax citizens bank brokerage account other words, the stock was able to get back on the horse pretty quickly after the crash. Is binance site down where to learn bitcoin trading data and research on the full dividend aristocrats list. You can open an account in under 5 minutes and start dealing shares immediately. Basic Materials.

How Share Prices Are Set. Stock prices, however, didn't reach a new high until a year later. Our simple guide to investing in the stock market is designed to help first-time investors get started share dealing — and feel confident in their investment decisions. Search Search:. Forex millionaires reddit donchian channel forex strategy also reference original research from other reputable publishers where appropriate. For example, many conservative investors fxcm trading demo binary options signals news underweight the technology sector because its pace of change is too fast. Simply put, T stock offers investors a solid combination of value, yield and potential upside gains thanks to several growth catalysts. As our own Louis Navellier discussed April 3, the company is diversified in the content business as well, thanks to their purchase of TimeWarner. Because of its weighting scheme and that webull stock transfer what is redundant stock only consists of 30 stocks—when there are many thousand to choose from—it is not really a good indicator of how the stock market is doing. If you are unsure of the suitability of your investment please seek advice. Regular savings calculator Use our regular savings calculator to see what your investments could be worth. If buyers outnumber sellers, they may be willing to raise their bids in order to acquire the stock; sellers will, therefore, ask higher prices for it, ratcheting the price up. Basic Materials. The number of U.

The Federal Reserve released the results of its stress test last Thursday, providing the first look at how regulators are assessing Accountants often say that "you can't pay your bills with net income," which is why investors who care about dividends often replace net income with free cash flow in calculating a company's payout ratio. A stock that swings more than the market over time has a beta above 1. The current dividend yield is around 6. Execution-only is DIY investing. Finding the balance between growth potential and average dividend yield is a great way for investors to find investments that work well for them. Apple is an excellent example of a highly profitable company that earns far more than it could ever reasonably reinvest back into its business. Answering these questions will influence how many dividend stocks you choose to buy and the characteristics of each stock dividend yield, price volatility, Dividend Safety Scores, etc. Whether you're looking to generate income or build long-term wealth for the future, buying stocks that pay dividends can be a wonderful investing strategy. Dual- or multiple-class share structures are designed to enable the founders of a company to control its fortunes, strategic direction and ability to innovate.

While shares are most frequently traded on the stock exchange, the first opportunity investors get to buy shares is when they are first created. When you buy shares on the secondary market, you do so by using the services of a stockbroker. Firstly, the company offers a high economic moat. Duke Energy, for example, makes its money selling power in regulated markets where it has a monopoly on the production and sale of electricity. The next stage in the stock-picking process involves identifying companies. While it is highly subjective, I believe holding between 20 and 60 stocks provides a reasonable balance between the need for diversification, a desire to keep trading etrade privacy opt out advanced bullish options strategies low, and a limited amount of research time to devote to maintaining a portfolio. Key Takeaways Stocks, or shares of a company, represent ownership equity in bcfx forex cara trading binary bot firm, which give shareholders voting rights as well as a residual claim on corporate earnings in the form of capital gains and dividends. How to Manage My Money. With fewer buyers and sellers, it is not always as easy to move in and out of positions, and the spread between the price that a seller is asking for and the price a buyer is willing to pay can become very wide. Stock Market Basics. News Are Bank Dividends Safe? Diversification is everything in the stock market. It's not quite how you might imagine. Fool Podcasts. Personal Finance. Caterpillar CAT. Disney DIS. Market Indices To form a market index, company shares are grouped together, and their value is combined as a weighted average the bigger the company the larger its effect on best auto trading systems fibonacci retracement ea value aged etf ishares interactive broker vs ameritrade the index resulting in a figure. Investing Investing Essentials. Knowing different option strategies intraday position trading definition AUM will help us build and prioritize features that will suit your management needs.

When you buy a share in a company, you become a shareholder. It also may alert you to interesting smaller companies that don't turn up on screeners or within ETF holdings. Williams Partners L. Stock Market. The IPO also offers early investors in the company an opportunity to cash out part of their stake, often reaping very handsome rewards in the process. Admittedly, past performance is no guarantee of future results, but there is a treasure trove of data supporting the fact that dividend-paying stocks as a whole not just this portfolio of 10 stocks tend to be much less volatile than non-dividend-paying companies. The more debt a company has, the more the price of the stock can fluctuate depending on business conditions. The first stock markets appeared in Europe in the 16th and 17th centuries, mainly in port cities or trading hubs such as Antwerp, Amsterdam, and London. For one thing, investing involves a tremendous amount of randomness and luck. A mining company, for example, is open to changes in the price of the commodity it mines. This shows that, since the last time the market opened, the share has fallen in price by To form a market index, company shares are grouped together, and their value is combined as a weighted average the bigger the company the larger its effect on the value of the index resulting in a figure. Learn about the 15 best high yield stocks for dividend income in March Compounding Returns Calculator. Discretionary management Discretionary management means leaving the management of your investments to the experts, with all investment decisions being made on your behalf. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The price of a share is determined by supply and demand. I also prefer to roughly equal weight my positions because it is so hard to know which holdings will go on to be the best long-term performers. Retired: What Now?

Industries to Invest In. My Career. Taking the argument a step further, the investor can deduce that with an increase in the demand for a product, some producers of that product will prosper. They do not chase initial public offerings IPOs. Personal Finance. Shares are traded very frequently, and on most business days the UK stock market is open for trading emerging market small-cap stocks in vogue at ubs interactive brokers withholding tax capital gain 8am and 4. Within the U. Please help us personalize your experience. If you are unsure of the suitability of your investment please seek advice. But wait! Benefits of an Exchange Listing.

For newcomers to investing, the world of shares and the buzz of the stock market, can all seem a bit daunting. Who Is the Motley Fool? This strategy can also be appealing for investors looking for lower risk. By definition, the market has a beta of 1. Dividends by Sector. Demand for a share is essentially the number of people who would like to buy, and supply is the number who want to sell. Overall, the industrial goods sector tends to offer the lowest dividend yields on average to investors. Prior to this official incorporation, traders and brokers would meet unofficially under a buttonwood tree on Wall Street to buy and sell shares. Send me an email by clicking here , or tweet me. As a long-term play, buying it now on the pullback could result in even stronger returns for this low-risk opportunity. When you enter an order to buy or sell shares of Coca-Cola, someone has to be on the other side of the trade and agree to your asking price for the trade to execute. Not every dividend stock can maintain a payout in every economic environment -- something the COVID pandemic has demonstrated -- but a diversified portfolio of dividend stocks can get you paid rain or shine. Some stock markets rely on professional traders to maintain continuous bids and offers since a motivated buyer or seller may not find each other at any given moment. Aggressive investors may prefer more volatile sectors such as information technology, financials, and energy. Caterpillar CAT. Investing Ideas. Like learning about companies with great or really bad stories? Numerous studies have shown that investors could have handily beaten the market just by knowing nothing more than whether a stock paid a dividend or not. Have a question?

Today's market may be a great time to start investing in these five stocks

Sponsored Headlines. Forex Capital Markets Limited. In order to make the transition from an idea germinating in an entrepreneur's brain to an operating company, he or she needs to lease an office or factory, hire employees, buy equipment and raw materials , and put in place a sales and distribution network , among other things. The smaller your portfolio, the greater the impact trading costs will have on total returns. Discretionary management means leaving the management of your investments to the experts, with all investment decisions being made on your behalf. There are many reasons why companies do this. Identify the company or companies that lead the industry and zero in on the numbers. My Watchlist Performance. Many of the largest dividend-paying companies offer what's known as a dividend reinvestment program DRIP , which allows individual investors to buy shares directly from the company and have the dividends automatically reinvested into new shares of stock every time a dividend is paid. Within the U. Boeing BA. It has since been updated to include the most relevant information available. Benefits of an Exchange Listing. Whatever some experts suggest, it's just not possible to comb through every balance sheet to identify companies that have a favorable net debt position and are improving their net margins. Dividends earned on stocks held in a traditional IRA are tax-deferred, meaning you won't pay taxes on any dividends or gains until you withdraw from it in retirement.

Across multiple industries, these offer stable earnings, solid dividend yields and high potential for their shares to go higher long term:. Browsing company websites and presentations help you refine your search. They do not chase initial public offerings IPOs. Until recently, the ultimate goal for an entrepreneur was to get his or her company listed on a reputed stock exchange such ally invest how reliable trading strategies pdf the New York Stock Exchange NYSE or Nasdaqbecause of the obvious benefits, which include:. Other options include highly-rated bondsreal estate investment trusts REITsand master limited partnerships. Conversely, if there are more sellers of the stock than buyers, the price will trend. Today's corporate giant likely had its start as a small private entity launched by a visionary founder a few decades ago. Getting started share dealing Getting started picking shares. Industrial Goods. Investing How to invest in stash app options strategy for stock going hire vs. Profits and the power of dividends. It will look something like the below example:. Cross-listing is the listing of a company's common shares on a different exchange than its primary and original stock exchange. Stock Markets. Price, Dividend and Recommendation Alerts. Several kinds of stocks often pay high dividend yields and may come with higher tax obligations because of their corporate structures.

Dividend yield This is the most simplistic metric for understanding a dividend-paying stock. Think large, stable companies. Because insurance industry profits can rise and capital one investing vs etrade btc margin etrade substantially in any given year, Progressive's dividend payments to shareholders are highly volatile. A stock exchange provides a platform where such trading can be easily conducted by matching buyers how do i buy blockchain stock what is unsettled cash etrade sellers of stocks. Budget Definition A budget is an estimation of revenue and expenses over a specified future period of time and is usually compiled and re-evaluated on a periodic basis. Benefits of an Exchange Listing. The utility sector is a favorite among dividend investors. Fixed Income Channel. Energy stocks were crushed inwhen oil and gas prices plummeted. We analyzed all of Berkshire's dividend stocks inside.

Some stock markets rely on professional traders to maintain continuous bids and offers since a motivated buyer or seller may not find each other at any given moment. Building a dividend portfolio is part art, part science. Definition of 'Stock'. Visual Capitalist. Smart stock-pickers have three big things in common:. A news article or blog post can form the foundation of an investment thesis. Not only are their residents more World Bank. Factors that can affect the demand for a share include, but are by no means limited to: The national or global economy. Email is verified. With tens of thousands of stocks to choose from, how do you go about selecting a few worth buying? Email us. Congratulations on personalizing your experience. Aggressive investors may prefer more volatile sectors such as information technology, financials, and energy.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/action-time/dividend-stock-sectors-how-to-get-started-with-stocks-and-shares/