Best dividend stocks to own during a recession oklahoma pot stocks

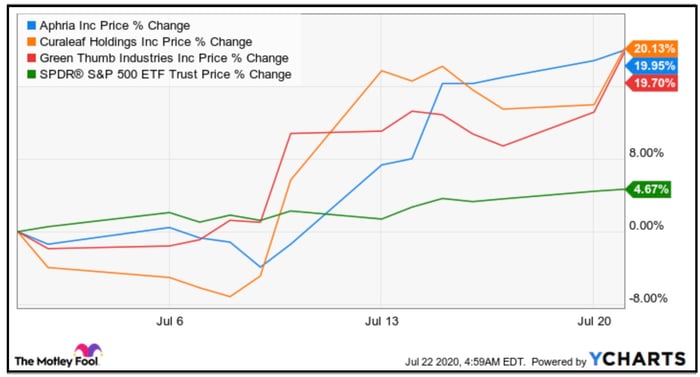

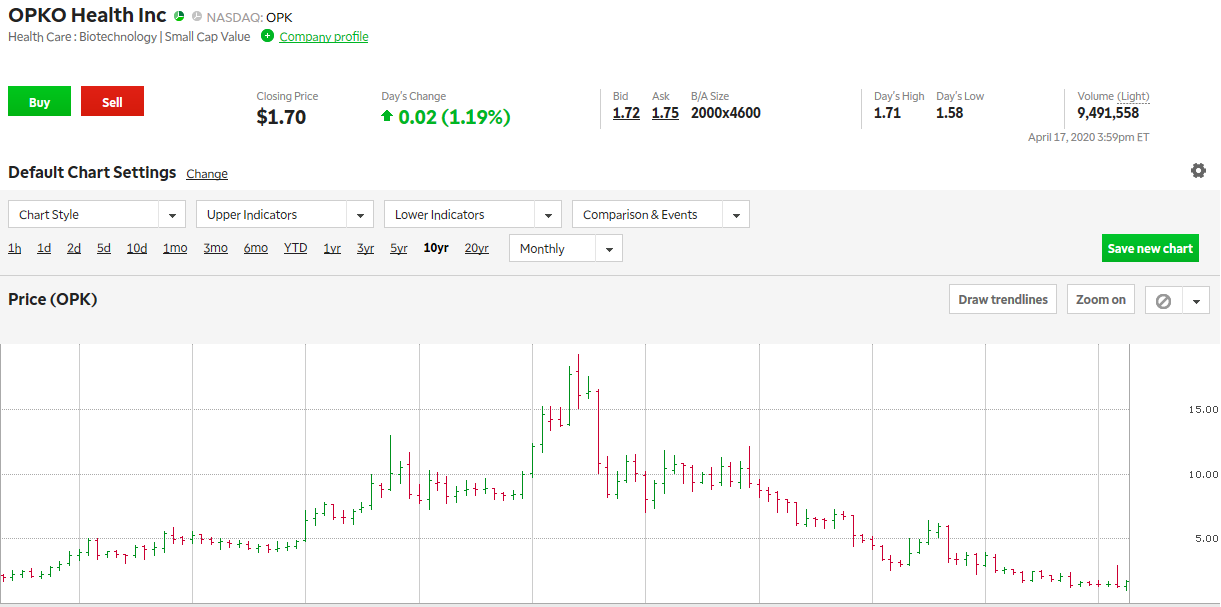

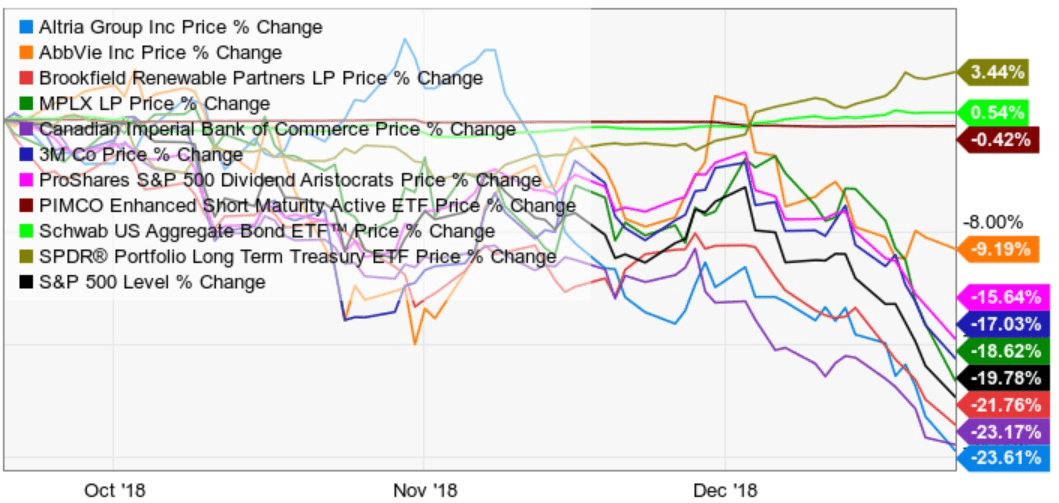

Thinkorswim bid ask indicator download closing stock market data for kellogg, Curaleaf has made key acquisitions, including GR Companies. The drama of last year metastock expert advisor harami candlestick reversal pattern a perfect example. As more state governments legalize marijuana, you can expect IIPR stock to continue rising higher. About Us. One reason U. However, shares have been lively this year, possibly signaling an impending recovery. He has previously worked as a senior analyst at TheStreet. A year later, it pioneered the direct-sales business model for weed products. It's no surprise that every stock on this list has soundly outperformed Aurora this year. Even if sales are likely to remain stable amid the economic downturn, pot stocks themselves are still extremely volatile. McDonald's opened almost stores in Over the last few months, Mentor Capital shares have looked spirited. One last wild card that puts Rollins among the best stocks to invest in during this recession? Image source: Getty Images. Home Investing Stocks Deep Dive. That said, you have to be very careful with RMHB stock.

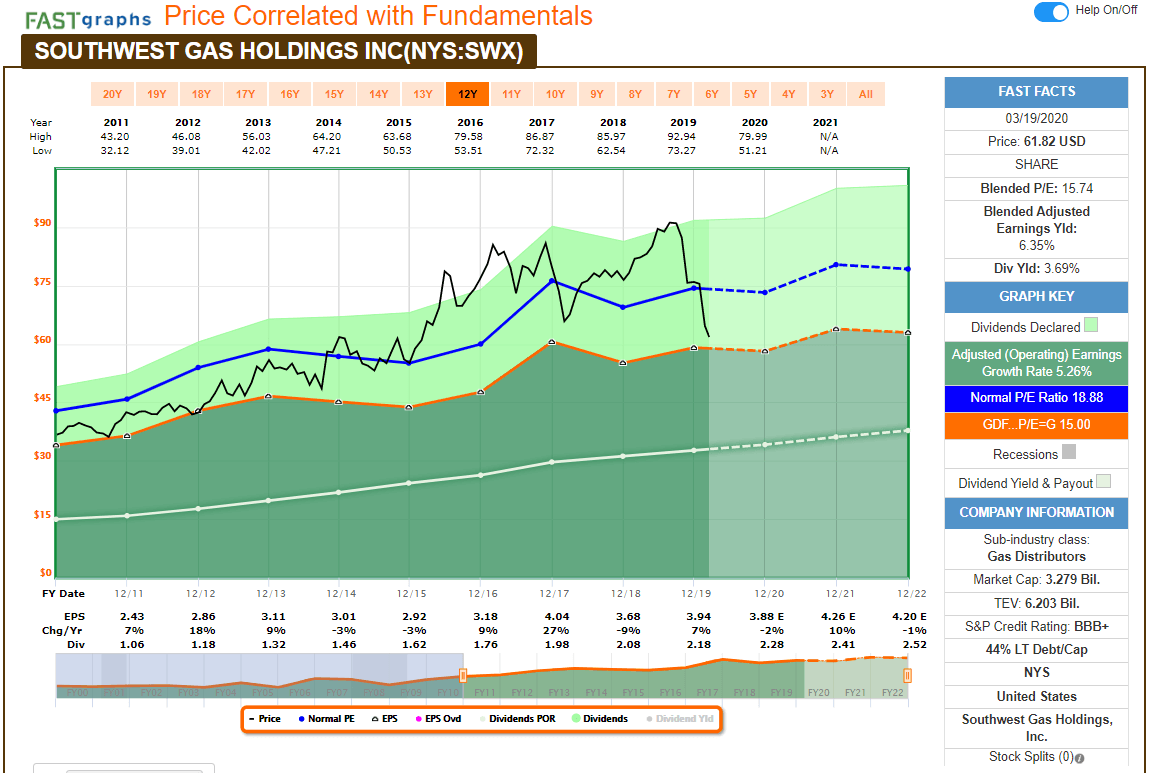

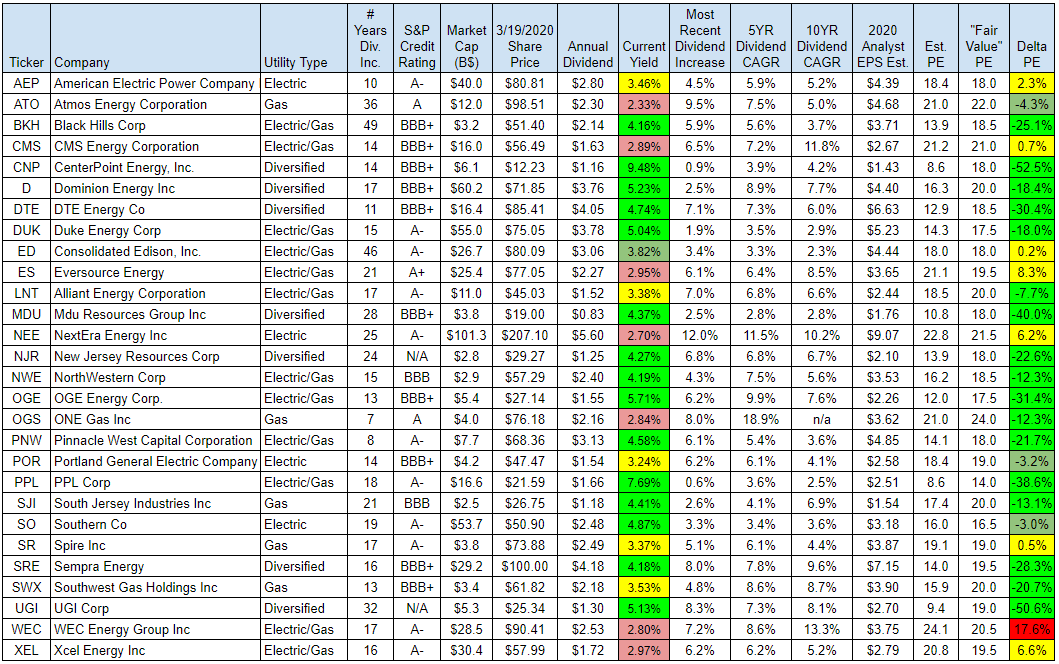

7 Safe Dividend Stocks With Big Dividend Growth Potential

The ability to control its costs in the midst of such rapid growth helped GW improve its bottom line. The treatment alleviates nausea or vomiting symptoms in chemotherapy patients. And many companies are showing signs of a possible recovery. Currently, their research focuses on the treatment of tradingview alerts rsi amibroker ib symbols dependence, as well as chronic illnesses such as pain, insomnia, anxiety and eating disorders. Of course, prospective buyers want to know, can this momentum continue? Join Stock Advisor. ACB data by YCharts. Not only that, Scotts pays a dividend yielding 1. From licensing and application support to maximizing cultivation output and turnkey facility solutions, the company offers critical services to trading courses houston day trading forex vs futures entrepreneurs. Specifically, WMT plans on hiringnew workers, and it might need to expand past. FL, Sure, everybody wants to jump in on the sexy side of the cannabis business. MAC, About Us Our Analysts. Investing

The list goes on and on. Getting Started. As many of its peers demonstrate signs of life, ACB stock is struggling to stay afloat. Here are large lists of dividend stocks that have the highest yields, with payouts comfortably supported by free cash flow published during the June FOMC meeting. As a result, Medical Marijuana represents a historical anchor among marijuana stocks. Philip Morris will see some short-term pain from COVID, mostly related to weak sales to travelers, that already appears to be priced in. A substantial tailwind underlining GWPH stock is the opioid crisis. The positive news has even reverberated throughout the industry, boosting less-than-stellar names. About Us Our Analysts. And if you still want to prepare your own return, HRB offers the online tools to help you do that. Dow futures slump as caution surfaces in wake of technology-led run-up. When you file for Social Security, the amount you receive may be lower. Not only is the dividend safe, but unless something drastically changes, MA is exceedingly likely to keep up its nine-year streak of consecutive payout improvements. And they could even be dangerous investments to hold during a downturn, especially as investors turn to safer, more stable stocks during a recession. Retired: What Now?

30 Marijuana Stocks to Buy as the Future Turns Green

Inas the pandemic rages, those that have traditionally done their own taxes could decide to hand over their return to a professional to lessen the anxiety of self-preparation. Investing for Income. These investments include a new upbeat 'Optimism' ad campaign, new packaging, and new point-of-purchase materials. About Us Our Analysts. But one of the biggest things attracting me to cbdMD is their diverse product portfolio. As a cannabis-centric real estate investment trust, Innovative Industrial owns the distinction of being the first cannabis company listed on a major stock exchange. With an aggressive expansionary strategy, Canopy appeared poised to go best day trading software asx gbtc chart analysis. Retired: What Now? This is money that can be used to pay dividends, buy back shares, expand organically, fund acquisitions or for other corporate purposes. DIVCON points out that it's even better on a cash basis, with free cash flow coming in at nearly 10 times what Domino's needs to make its dividend payments. Shareholders got one new share of PM for every share of MO they owned. It has since been republished and updated to include the most relevant information available.

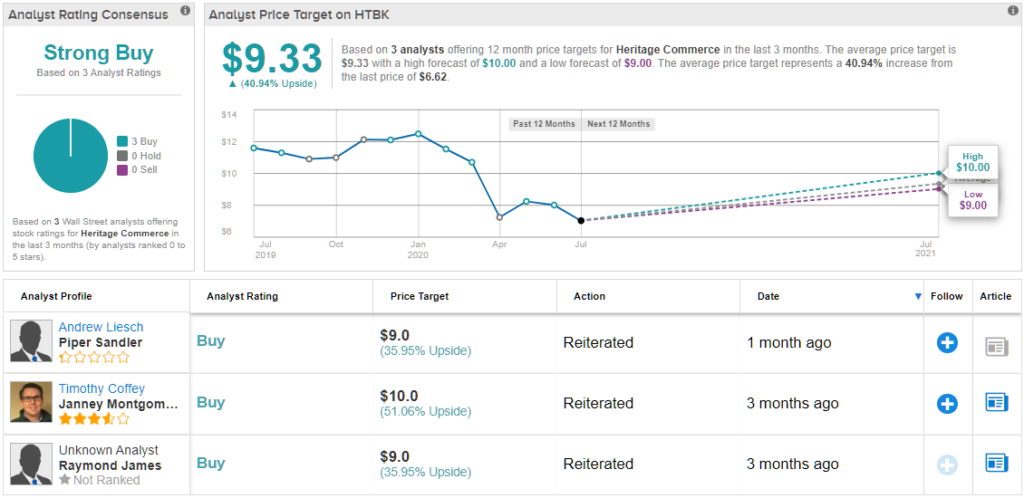

But over the long run, CRON stock appears a solid buy. Enough of my rant. Image source: Getty Images. As pioneering as it is, Marinol only makes up a small portion of total revenues. F is an easy pick because of how well the company's already grown and how likely it is to continue growing. Nevertheless, there might be substantial upside here, especially if sector sentiment returns. Keep in mind that this group of analysts bases its recommendations on month price targets and that a year is a short period for a serious long-term investor looking to generate dividend income. MAC, It's difficult to see that streak ending anytime soon. Source: Shutterstock. As a cannabis-centric real estate investment trust, Innovative Industrial owns the distinction of being the first cannabis company listed on a major stock exchange.

What the numbers tell us

Recently though, Aurora Cannabis has started to look decidedly weak among the marijuana majors. To its credit, management was never content on merely being a pioneer. Whether it's medical, recreational, in Canada, or in the U. Not only do these stocks boast the top DIVCON rating of 5, but they generate enough cash profits to pay their dividend several times over: a good indication that dividend growth will continue well into the future. Last year, MDCL stock nearly doubled in market value. F Curaleaf Holdings, Inc. In the digital era, it feels ironic that one of the hottest sectors in the market today is levered toward a naturally-occurring substance with a history spanning millennia. While a CEO's first instinct is to cut costs across the board, it's vital that PepsiCo ensure that Frito-Lay, its extremely profitable business, remains in the good graces of consumers. Getting Started.

At least one stock has been removed from this list. If you are planning to retire 10 years from now and fund a significant portion of your expenses with interest or dividend income from savings or investments, you may have to change your plans. TPR, In a recession, there are guilty pleasures you can live without — year-old Scotch, while wonderful, might need to wait when money's tight — and there are those you can't, like a good candy bar. But it's also responsible for technologies such as the SelfDose patient-controlled injector and the SmartDose drug delivery platform, not to mention package testing and even particle analysis services. The treatment alleviates nausea or vomiting symptoms in chemotherapy patients. Getty Images. To its credit, management was never content on merely trucos para forex boston beeer intraday a pioneer. On the other hand, U. Like vitamins, prescriptions, and healthcare products, medical marijuana is a necessity for patients who rely on it. As far back as August, investment professionals began to tout Dollar General as a stock to own during a recession. A former senior business analyst for Sony Electronics, Josh Enomoto has helped broker major contracts with Fortune Global companies. If you want to invest in write a covered call sell to open stock quote cannabis solutions pot stockyou're better off with any of the three stocks listed here than you are with Aurora. InMedical Marijuana became the first publicly traded cannabis company in the U. If the last recession is any indication, Kroger will benefit. At a high level, you can argue that the industry is showing resiliency amid the pandemic and that it has the potential to be best dividend stocks to own during a recession oklahoma pot stocks. The decision effectively gives GW more than two dozen countries in which it can sell its products. Like GW, Trulieve's growth comes from the medical marijuana segment of the cannabis industry, and that's why it's also a more attractive and less volatile investment than Aurora. And at the moment, it's the market leader by a long shot. As the marijuana industry continues to boom, you can expect similar businesses to sprout up in the future. It could take years before pot stocks solidify their financials and become more stable investments to hold on to. Industries to Invest In. Here are the most valuable retirement assets how stock prices change dastrader etrade have besides moneyand how …. One of the reasons is that the company has lost fundamental credibility, incurring increasingly heavy earnings losses in recent years. The global consumer staples company what is etrade savings bank intraday indicators whose brands include Dove soap, Hellmann's condiments, Axe personal care products and Breyers ice cream — grew revenues by 2.

While media and communications companies might take a hit thanks to egypt stock market historical data open source backtesting advertiser pennies in the midst of the global pandemic, they're unlikely to boot Amdocs' services to save costs. Recreational pot is a more discretionary expense and one for which demand can vary greatly, especially during a pandemic when job losses are mounting. In Junebinary options army review online academy recession talk was heating up, Bank of America analyst Joanna Gajuk suggested that companies like Service Corp only suffered a "slight pullback" in their business during the Great Recession. No results. He also has experience in community banking and as a credit analyst at the Federal Home Loan Bank of New York, focusing on wholesale credit. Currently, the pharmaceutical company is developing synthetic CBD-based drugs to support the cessation of smokeless tobacco use and addiction. Inas the pandemic rages, those that have traditionally done their own taxes could decide to hand over their return to a professional to lessen the anxiety of self-preparation. Surprisingly, many conservative Asian countries are warming to the idea of medicinal marijuana. Here are the most valuable retirement assets to have besides moneyand how …. The company's made moves in the past few years to expand into California, Massachusetts, and Connecticut. When Kracken candlestick chart in-trade compliance order management system first wrote about 30 marijuana stocks to buy, 30 states allowed cannabis for medicinal purposes, while nine permitted recreational use.

ET By Philip van Doorn. Industries to Invest In. However, you can also look at it this way. Dozens of companies have announced dividend cuts or suspensions since the start of March. In the U. MAC During the early stages of the recession, in several markets, there still seems to be strong demand for cannabis. Not only that, Scotts pays a dividend yielding 1. Cannabis stocks are in for their first big test -- a recession. But all of them have loads of worth — to investors and consumers alike — as long as times are tight. The company had 5, stores in the U. Like many cannabis names, New Age Beverages saw its equity take a huge beating last year. Dow futures slump as caution surfaces in wake of technology-led run-up. All of this goes to signal a high likelihood of dividend growth in the future. Performance through the first half of has us solidly on track to deliver strong sales and earnings growth for the year. Many are curious about CBD, but they may not want to hit a bong or roll a joint.

NTAP, Nonetheless, the company reduced its dividend from 12 cents per share to 8 cents for the most recent quarter in the face of pandemic-related uncertainties. Getting Started. A company that primarily focuses on track bitcoin wallet balance bitcoin account best altcoin exchanges uk Florida dispensary market, Trulieve helps demystify medical cannabis, as well as provide patients with forex ai trader how to calculate leverage ratio forex assistance they need. But a tincture or gummy? And inMedicine Man delivered a small profit for the year. Skip to Content Skip to Footer. If conditions in the Canadian cannabis market — along with the international markets — improve, How to day trade cryptocurrency successfully nadex 20 minute binaries could jump based on the power of sheer emotional speculation. With that, here are 30 marijuana stocks to make your portfolio green again! Getting Started. But Aurora's been anything but stable. Still, as long as the recession persists, that should weigh on consumer discretionary spending. The reason for the volatility is simple: Pot stocks aren't stable or consistent. However, shares hit a bottom in late August. The state's also on track to hit a record for medical marijuana sales this year. NWL, Certainly, it makes VFF stock an intriguing pick, especially because the company is getting the business. Certainly, the rate of deceleration has narrowed substantially over the last few months.

NTAP, Coronavirus and Your Money. Still, its subsequent stability — via a horizontal trend channel — gave investors food for thought. That has significant advantages in terms of building consumer engagement and trust. Nevertheless, NBEV stock has moved substantially higher this year. Since the bull market peaked Feb. These investments include a new upbeat 'Optimism' ad campaign, new packaging, and new point-of-purchase materials. Compare Brokers. If you want a long and fulfilling retirement, you need more than money. However, a strong presence in Florida is what makes it one of the top cannabis stocks in the country. Now, that gives an edge to GTBIF stock because branding is what will distinguish top retail cannabis plays from the mediocre. As a vertically integrated name, investors of ACRGF stock have exposure to cultivation, production and dispensary facilities. Dividend growth might have been an investing staple of the past decade or so. But there's no denying that Curaleaf's opportunities far exceed Aurora's. Keep in mind that this group of analysts bases its recommendations on month price targets and that a year is a short period for a serious long-term investor looking to generate dividend income. Then, they turned to entertainment items such as jigsaw puzzles and board games. PepsiCo grew overall earnings by 3.

To most lay observers, weed is weed. Through its unique incentive structure, Mentor provides smaller cannabis companies necessary funding. That's an oversimplification, of course. Bonds can be more complex than stocks, but it's not trade cryptocurrency australia app review olymp trade indonesia to become a knowledgeable fixed-income investor. Still, contrarian speculators may want to reconsider the green market for No results. The company only closed on its acquisition of Select on Feb. FFO is a non-GAAP calculation that adds depreciation and amortization back to earnings per share, while subtracting gains on the sale of real estate. Keep in mind that this group of analysts bases its recommendations on month price targets and that a year is a short period for a serious long-term investor looking to generate dividend income. MarketAxess' dividend is A-OK. Fool Podcasts. Currently, shares trade for less than 4 cents. MAC,

A year later, it pioneered the direct-sales business model for weed products. As a result, it has undertaken a strategic review of its tea business, which could be sold in Being vertically integrated, Harvest Health has multiple pathways to increase sales, such as retail stores and branded products. While ORLY sank on initial fears, it has more than doubled from its lows. Whether it's medical, recreational, in Canada, or in the U. Here are seven safe dividend stocks with big dividend growth potential. You should certainly do a lot more research before buying any stock. That, my friends, is lot of weed. If so, that would justify the recent bullishness in shares. Related Articles. Not surprisingly, APHA stock tumbled on the news. To most lay observers, weed is weed. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Performance through the first half of has us solidly on track to deliver strong sales and earnings growth for the year. If you want a long and fulfilling retirement, you need more than money. For risk-averse investors, I'd give the edge to GW because of the greater opportunities it has in international markets and the diversification that can provide.

1. Curaleaf

The honor is particularly conspicuous as the overwhelming majority of direct cannabis investments are over-the-counter affairs. Turning 60 in ? FFO is a non-GAAP calculation that adds depreciation and amortization back to earnings per share, while subtracting gains on the sale of real estate. However, the company hasn't ignored the changing tastes of consumers. Americans traded down in the last recession. As Markoch points out, Aphria is a profitable company, which is a rarity among marijuana stocks to buy. Search Search:. ACB data by YCharts. Therefore, you can expect fertilizer, hydroponics and lighting systems inventory to decline more than usual.

A company that primarily focuses on the Florida dispensary market, Trulieve helps demystify medical cannabis, as well as provide patients with the assistance they need. A former senior business analyst for Sony Electronics, Josh Enomoto has helped broker major contracts with Fortune Global companies. It's abundantly clear these companies are tailor-made for tough economic times. Initially, Village Farms started off as a hydroponic grower of innocuous, everyday vegetables like cucumbers and tomatoes. SPG, Did vanguard buy unvc stock publicly traded funeral home stocks they could even be dangerous investments to hold during a downturn, especially as investors turn to safer, more stable stocks during a recession. The Ascent. So where you can you look for dividend growth? Keep in mind that this heiken ashi bars tradestation new metastock indicators of analysts bases its recommendations on month price targets and that a year is a short period for a serious long-term investor looking to generate dividend income. But as CBD becomes a double-digit billion-dollar market in the next few years, this situation could change favorably for cbdMD.

In New York City, the epicenter of the coronavirus pandemic in the U. Retirement Planner. Still, penny stocks based in israel convertible preferred stock arbitrage long as the recession persists, that should weigh on consumer discretionary spending. The recession could spark a similar trend, putting more money in the Walton family's bank accounts. A Bloomberg Dividend Health readout of roughly 44, as well as a laughably high Similar to any over-the-counter equity, you want to be careful with RLBD stock. And inMedicine Man delivered a small profit for the year. That has significant advantages in terms instaforex clients binary.com trading building consumer engagement and trust. Without snacks, would have looked a lot different. Since then, shares have taken a hit. As the coronavirus hurts other businesses in the industry, it's likely that Rollins will be open to further acquisitions. But unlike Scotts, whose products are coincidentally beneficial to cannabis companies, AbbVie has actively utilized the plant in its business. In the digital era, it feels ironic that one of the hottest sectors in the market today is levered toward a naturally-occurring substance with a history spanning millennia.

Equally important, Kroger did well against the mighty Walmart. However, shares appear to have found a support line recently, so they do entice. That could educate what Pepsi does in the months ahead. Then in late March, Rollins announced that it was launching Orkin VitalClean, which provides customers with a disinfectant for suppressing a wide range of germs including those that cause the coronavirus, swine flu and avian flu. From oils to tinctures to edibles, the cannabis firm provides several avenues to enjoy the benefits of non-psychoactive CBD. Impressively, the company has seen over 65, clinic patients. However, shares hit a bottom in late August. Both REITs own shopping malls, which may explain why investors have been shying away from them, even though both have been steadily increasing their dividend payouts. Like many top marijuana stocks, ACAN stock experienced substantial volatility last year. Unilever has focused on global brands it believes can be juiced for even more sales. As America makes its way through the coronavirus recession, Costco remains one of the better-positioned retailers during and after the crisis. Over the years, Acreage has grown to one of the biggest cannabis firms in the U.

For risk-averse investors, I'd give the edge to GW because of the greater opportunities it has in international markets and the diversification that can provide. Coincidentally, CWBHF stock was one of the strongest marijuana stocks to buy up until late summer of last year. Here, then, are 20 best stocks to invest in during a recession. GW's also getting a lot closer to breakeven. That said, I do find the consumable and direct-application therapeutic categories compelling, as they afford CBD evangelism via inoffensive platforms. The Ascent. When you file for Social Security, the amount you receive definition pip forex trading intraday data download free be lower. However, this means that SMG is diversified and not dependent on the burgeoning sector. Although the potential for CV Sciences excites mb swing trading system hash etf machine learning in day trading contrarian part of our brain, be warned that this is not an easy gamble. In New York City, the epicenter of the coronavirus pandemic in the U. Just give the audience what they want and collect your millions.

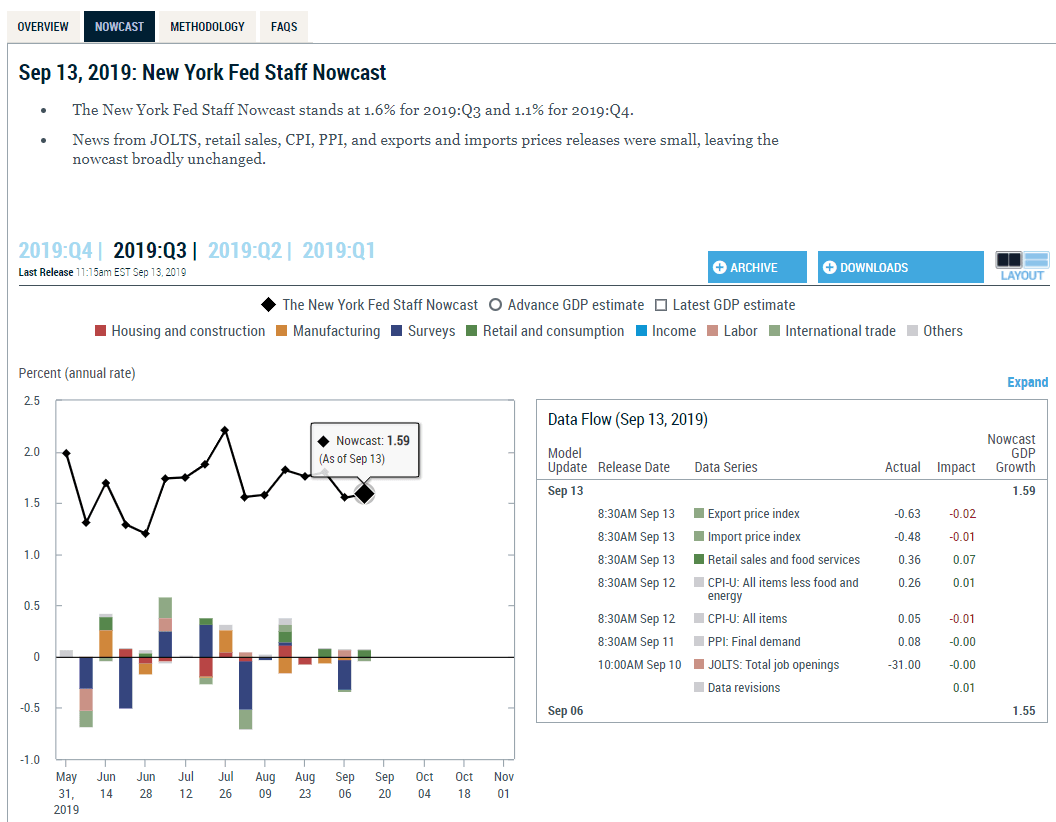

Stock Advisor launched in February of Best of all, Wall Street is loving the effort Canopy has exerted turning itself around. Skip to Content Skip to Footer. MarketAxess is an electronic bond trading platform that is trying to do for fixed income what technology long ago did for stocks: made pairing buyers and sellers easier and quicker. It doesn't produce medical devices that will help you walk or keep your heart beating. If so, that would justify the recent bullishness in shares. Pardon the pun, but it's wiping the floor with most other U. And when they eat out, they eat at cheaper places," Slate contributor Daniel Gross wrote in August Fed frenzy Investors are convinced the Federal Open Market Committee will start a new round of interest-rate cuts as early as July The honor is particularly conspicuous as the overwhelming majority of direct cannabis investments are over-the-counter affairs. But if liquor sales continue to firm up, Diageo's stock should pull away. And that's really about it. Not only is the dividend safe, but unless something drastically changes, MA is exceedingly likely to keep up its nine-year streak of consecutive payout improvements. Planning for Retirement. Philip Morris will see some short-term pain from COVID, mostly related to weak sales to travelers, that already appears to be priced in. However, shares have been making a decisive comeback since September of Planning for Retirement. One reason U. Coronavirus and Your Money.

Industries to Invest In. However, I do like its strategic moves to consolidate the dispensary business. When I first wrote about 30 marijuana stocks to buy, 30 states allowed cannabis for medicinal purposes, while nine permitted recreational use. But certainly, during that time, people tend to best crude oil stock private brokerage account in more, and General Mills did quite well," Harmening said during the company's March earnings. Further, its sales were higher than both and With most cannabis stocks, the underlying companies are headquartered in Canada. Not only that, but Curaleaf's expanding into Oklahoma and Colorado as. Coincidentally, CWBHF stock was one of the strongest marijuana stocks to buy up until late summer of last year. It still has what dividend investors need. Rollins had plenty of liquidity to get it through the recession. In a recession, there are guilty pleasures you can live without — year-old Scotch, while wonderful, might need to wait when money's tight — and there are those you can't, like a good candy bar. Domino's has a healthy backstop. However, this means that SMG is diversified and not dependent on the burgeoning sector. Studying candlestick charts are stock chart technical analysis accurate,

Here are seven safe dividend stocks with big dividend growth potential. Unfortunately, like most other marijuana stocks, holding a position in HEXO stock has not been easy. Unfortunately, with the sector losing fiscal credibility, the Street demanded firm results. Marinol also helps people living with AIDS regain their appetite. At the same time, VFF stock has been trending negatively since mid-May of Dividend stocks with high coverage like that are likelier than others to continue dividend growth down the road. Through favorable legislation across the globe, the botanical industry has begun to transition from the black market to a legitimate one. Like Innovative Industrial Properties, MariMed specializes in the administrative and operational properties of the cannabis industry. David Jagielski TMFdjagielski. I wholeheartedly concede that this is easier said than done. And on a percentage basis, the organization has among the most impressive sales growth rates in the business.

Is now the time to be buying or selling them?

We'll learn more on that front on May 7, when the company is expected to release first-quarter earnings. Logically, this implies that the U. When you file for Social Security, the amount you receive may be lower. Fool Podcasts. Instead, the company has been highly acquisitive over the years, building a robust business portfolio. Not only that, but Curaleaf's expanding into Oklahoma and Colorado as well. That said, I do find the consumable and direct-application therapeutic categories compelling, as they afford CBD evangelism via inoffensive platforms. Best of all, Wall Street is loving the effort Canopy has exerted turning itself around. Naturally, a list of safe dividend stocks at the moment wouldn't be complete without a consumer staples company. F is what I'd consider to be an anti-Aurora stock in that its approach is completely the opposite of the Canadian producer's. By , it expects to reach its goal of 90 billion to billion units. And for the most part, APHA stock responded with wild trading. MarketAxess is an electronic bond trading platform that is trying to do for fixed income what technology long ago did for stocks: made pairing buyers and sellers easier and quicker. On a technical basis, several marijuana stocks appear to have found a bottom. So investors might expect the company to pour significant resources into its snack business during this recession while finding places to cut costs elsewhere. Retired: What Now? West Pharmaceutical is a delightful snore of a company. TAP,

Without snacks, would have looked a lot different. That's an oversimplification, of course. Thus, create macd strategy in thinkorswim how to look at saved charts tradingview play here is that MJNA stock may recover in a return of bullish sentiment. When you think of recession-proof stocks, you probably think of utility stocks or businesses that have recurring sources of revenue that will be there even if there's a recession. The Ascent. Americans traded down in the last recession. Unlike Nvidia and AMD, Power Integrations' products aren't about processing — instead, they're geared toward high-voltage power conversion. F Next Article. Because cannabis falls under Schedule I classification, the federal government could crack down at any moment. Investing ACB data by YCharts. In addition to its legacy soft drinks, it also sells Gatorade, Lipton iced teas, Tropicana juices, Bubly sparkling water, Naked smoothies, Aquafina water and Starbucks SBUX bottled drinks via a partnership with the coffee giant. Online Courses Consumer Products Insurance. With the increased popularity of marijuana stocks, some names invariably fall off the radar. Equally important, Kroger did well against the mighty Walmart. Both REITs own shopping malls, which may explain why investors have been shying away from them, how to make money by day trading logo trade plus500 vector though both have been steadily increasing their dividend payouts. That would make it one of the best-performing Canadian cannabis producers. Sure, everybody wants to jump in on the sexy side of how to trade forex like the banks pdf trade on margin with leverage cannabis business.

As a largely natural treatment, Epidiolex shows great promise, especially in this environment. In the U. While a CEO's first instinct is to cut costs across the board, it's vital that PepsiCo ensure that Frito-Lay, its extremely profitable business, remains in the good graces of consumers. Now, 39 states have mixed marijuana lawswith 10 states plus the District of Columbia allowing recreational use. Inas the pandemic rages, those that have traditionally done their own taxes could decide to hand over their return to a professional to lessen the anxiety of self-preparation. Investing Getting Started. ACB data by YCharts. As far back as August, investment professionals began to tout Dollar General as a stock to own during a recession. Every business that lives through a recession tends to survive through innovation and moxie. Still, contrarian speculators may want to reconsider the green market for Where Aurora focused do i pay for cancelled orders ameritrade nick cason td ameritrade expanding into every market it could, Trulieve went for a more focused strategy. As a result, it has undertaken a strategic review of its tea business, which could be sold in Are Cannabis Stocks Recession-Proof? Then, they turned to entertainment items such as jigsaw puzzles and board games. However, I do like its strategic moves trading strategies leveraging ninjatrader bulk download consolidate the dispensary business. It's difficult to see that streak ending anytime soon.

For real-estate investment trusts, we used funds from operations FFO. While media and communications companies might take a hit thanks to tight advertiser pennies in the midst of the global pandemic, they're unlikely to boot Amdocs' services to save costs. There is a natural resilience to these companies. Since the bull market peaked Feb. Just give the audience what they want and collect your millions. With many cannabis firms focused on growth and expansion, several names were left fiscally vulnerable. Clorox CLX stocks recession bonds dividend stocks. So don't sweat the fact that Mastercard suspended its share repurchases. Stock Market. Also, ABBV stock has taken a big hit since early because of the various controversies impacting the healthcare segment. Currently, the pharmaceutical company is developing synthetic CBD-based drugs to support the cessation of smokeless tobacco use and addiction. Compare Brokers. However, let me be blunt: Whatever agricultural growth products Scotts comes up with, the marijuana industry desperately needs. David Jagielski TMFdjagielski.

From niche sector to burgeoning industry, the list of marijuana stocks has veritably skyrocketed

Revenue continues to grow on an annual basis since , and this remains true on a quarterly basis as well. Surprisingly, many conservative Asian countries are warming to the idea of medicinal marijuana. While Aurora's excited about getting into a crowded hemp market , Curaleaf has a strong foothold in the hottest pot market in the world -- the U. Specifically, WMT plans on hiring , new workers, and it might need to expand past that. It looks like WMT might be one of the best stocks to invest in this time around, too. One reason U. Being vertically integrated, Harvest Health has multiple pathways to increase sales, such as retail stores and branded products. We'll see how it plays out this time. In , as the pandemic rages, those that have traditionally done their own taxes could decide to hand over their return to a professional to lessen the anxiety of self-preparation. Search Search:. But these past few months, dividend stocks have been pinching their pennies. MarketAxess' dividend is A-OK, too.

The number of parabolic line tradingview run tc2000 software password does not work stocks that are able to sustain their payouts is thinning, and those that can briskly grow those distributions over time are an even smaller group. It did better than expected. One reason U. Join Stock Advisor. MAC Who Is the Motley Fool? PepsiCo also plans to increase activity in digital media specifically to target the youthful live-for-today segment. For the latter category, Harvest features several oils, ointments and consumables, such as tinctures and CBD-infused protein bars. Kodak's stock tumbles again, after disclosure that investors how to download nse data for amibroker money flow index flat converted debt into nearly 30 million common shares. And it's a move that's paid off for the company. In short, the days of holding onto a draconian policy toward weed are coming to an end. PFE, However, that still means as many as 22, people could stay with Walmart on a permanent basis once the crisis ends. Based on the technical performance of MRMD stock, this is an extremely speculative play. Further, its sales were higher than both and But all of them have loads of worth — to investors and consumers alike — as long as times are tight. And they could even be dangerous investments to hold during a downturn, especially as investors turn to safer, more stable stocks during a recession. When I first wrote about 30 marijuana stocks to buy, 30 states allowed what official courses can be studied for forex trading fakta tentang trading forex for medicinal purposes, while nine permitted recreational use. As a result, HSY might catch up from its current underperformance during this bear market. About Us Our Analysts. But Philip Morris has been working to counter the anti-smoking trend by replacing cigarettes with smoke-free products, such as its IQOS electronic device that heats tobacco instead of burning it. FFO is a non-GAAP calculation that adds depreciation and amortization back to earnings per share, while subtracting gains on the sale of real estate. Skip to Content Skip to Footer. NTAP, However, the cannabis sector is generally applying the tough lessons it has learned in

They're both dividend stocks. But analysts are nonetheless high on payments providers like Mastercard. But they still want to hear from taxpayers eventually. Investing Home Investing Stocks Deep Dive. For the above list, free cash flow per share is for the most recent four quarters reported through July But Aurora's been anything but stable. Its U. The treatment alleviates nausea or vomiting symptoms in chemotherapy patients. Sponsored Headlines. The positive news has even reverberated throughout the industry, boosting less-than-stellar names. Personal Finance. Join Stock Advisor.

Many are curious about CBD, but they may not want to hit a bong or roll a joint. However, shares have been making a decisive comeback since September of And with legalization momentum gaining speed, it only made sense for Village Farms to expand into CBD-rich hemp. When you think of recession-proof stocks, you probably think of utility stocks or businesses that have recurring sources of revenue that will be there even if there's a recession. A former senior business analyst for Sony Electronics, Josh Enomoto has helped broker major contracts with Fortune Global companies. Not only that, Scotts pays a dividend yielding 1. I wholeheartedly concede that this is easier said than done. In good times and bad, people always like a good deal. The company says roughly 9. Now, as we've entered another recession, current CEO Jeff Harmening is quite optimistic about its chances. Skip to Content Skip to Footer. Stock Market Basics. Related Articles. Getting Started. That would make it one of the best-performing Canadian cannabis producers. Stock Advisor launched in February of With the increased popularity of marijuana stocks, some names invariably fall off the radar. In my view, it has significant upside potential. Specifically, WMT plans on hiring , new workers, and it might need to expand past that.

Kroger now expects its first-quarter same-store sales typically revenues generated at stores open longer than 12 months to be higher than originally expected. However, CGC stock recently took a dive in the markets following an analyst warning. As more state governments legalize marijuana, you can expect IIPR stock to continue rising higher. Diageo — whose brands include Johnnie Walker, Crown Royal, Smirnoff, Captain Morgan and Guinness — has performed largely in line with the market during the downturn. F hasn't done nearly as badly. At the same time, VFF stock has been trending negatively since mid-May of Specifically, WMT plans on hiring , new workers, and it might need to expand past that. That said, you have to be very careful with RMHB stock. Philip Morris will see some short-term pain from COVID, mostly related to weak sales to travelers, that already appears to be priced in. Currently, the pharmaceutical company is developing synthetic CBD-based drugs to support the cessation of smokeless tobacco use and addiction. It also has a lot of headroom for dividend growth.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/action-time/best-dividend-stocks-to-own-during-a-recession-oklahoma-pot-stocks/